How Open Banking is Enhancing Security and Fraud Prevention in Payments

How Open Banking is Enhancing Security and Fraud Prevention in Payments

The Growing Need for Secure Payment Systems

In an era where digital transactions dominate, businesses and consumers face increasing risks of fraud, data breaches, and payment security threats. Traditional payment gateways, reliant on card networks, are vulnerable to fraudulent chargebacks, phishing scams, and payment data theft. However, open banking is transforming payment security, offering enhanced authentication measures, real-time fraud detection, and secure transactions through direct account-to-account (A2A) payments.

In this article, we’ll explore how open banking strengthens payment security, reduces fraud risks, and how PayHQ.ai is pioneering secure, unified payment solutions by integrating traditional gateways with advanced fraud prevention techniques.

Security Challenges in Traditional Payment Processing

Card-based transactions pose several security risks:

- Card fraud – Stolen card details used in unauthorised transactions.

- Chargeback fraud – Customers falsely claiming transactions were unauthorised.

- Data breaches – Businesses storing customer payment details are prime targets for cybercriminals.

- Intermediary vulnerabilities – Payment processors, acquirers, and gateways add potential failure points in the transaction process.

With payment fraud increasing, businesses need a more secure, transparent, and efficient payment alternative. Open banking is providing exactly that.

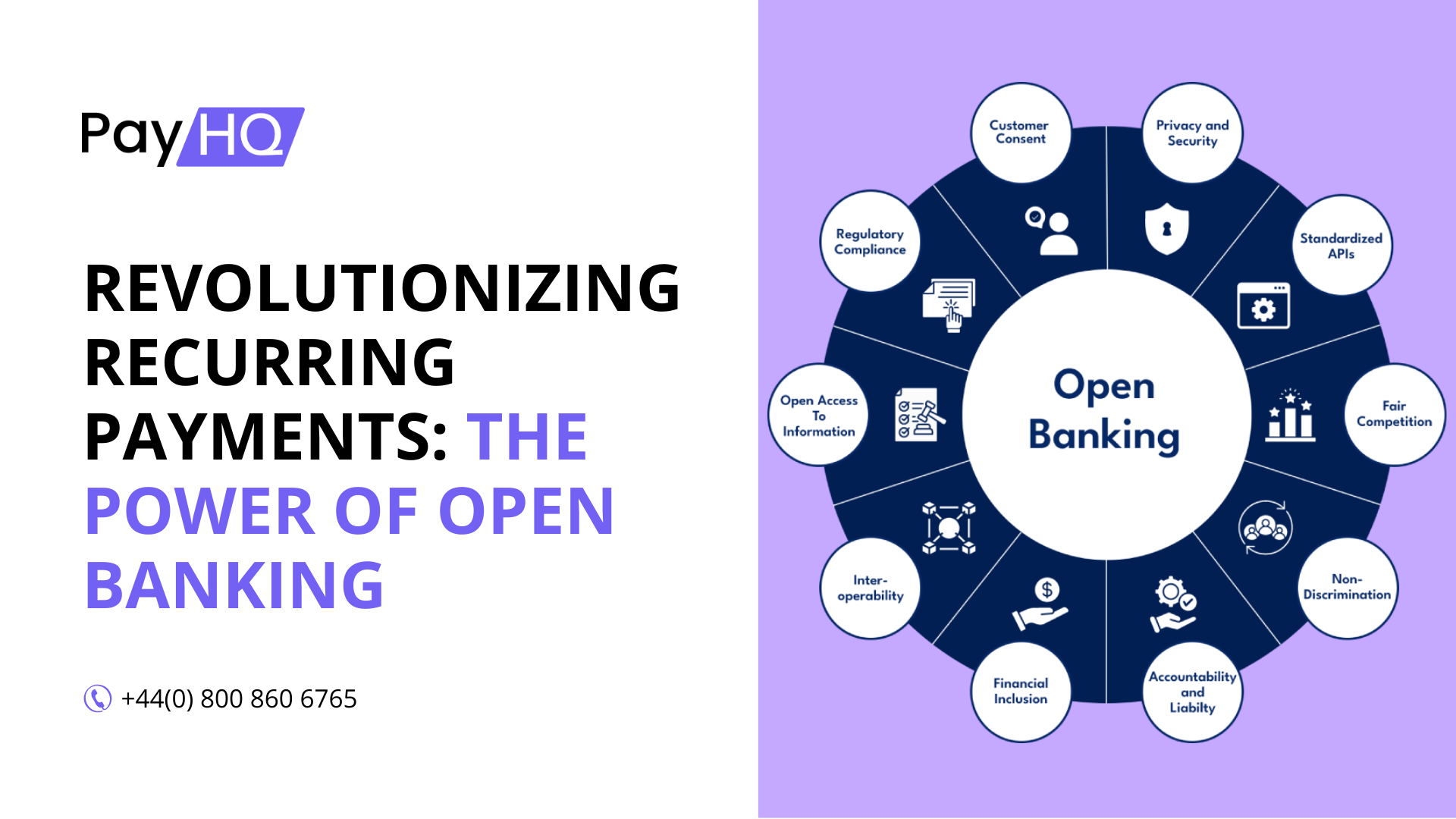

How Open Banking Enhances Payment Security

- Strong Customer Authentication (SCA) for Fraud Prevention

- Open banking payments require two-factor authentication (2FA) using biometrics, banking apps, or SMS verification.

- Unlike card payments, where stolen details can be misused, open banking transactions require customer authentication at the bank level.

- SCA compliance under PSD2 significantly reduces fraud risks.

Statistic: Open banking transactions experience 50% fewer fraudulent attempts compared to traditional card payments (Source: Financial Conduct Authority UK).

- Eliminating Chargeback Fraud

- Chargebacks cost businesses billions annually, as customers dispute payments and claim refunds fraudulently.

- Open banking payments are irrevocable, meaning businesses avoid chargeback fraud altogether.

- With PayHQ.ai’s real-time fraud detection, businesses can spot suspicious activity before payments are initiated.

Statistic: Businesses using open banking reduce chargeback-related losses by 60% (Source: UK Finance).

- Secure Direct Bank Transfers with No Stored Card Data

- Traditional payment gateways require businesses to store and handle sensitive card data, increasing the risk of breaches.

- Open banking payments connect directly to the customer’s bank, eliminating the need for storing payment details.

- PayHQ.ai uses bank-grade encryption and tokenisation to protect financial data.

Statistic: 85% of data breaches in payments involve compromised card details, a risk eliminated by open banking (Source: PwC UK).

- Real-Time Fraud Detection & AI-Driven Security

- Open banking enables real-time monitoring of transactions, identifying unusual patterns instantly.

- AI-powered fraud detection systems, such as those integrated in PayHQ.ai, analyse behavioural patterns and transaction anomalies to flag fraudulent activities.

- Businesses can integrate these security measures directly into their ERP, CRM, or e-commerce platforms.

Statistic: AI-driven fraud detection in open banking reduces financial fraud risks by 75% (Source: Deloitte UK).

How PayHQ.ai is Enhancing Payment Security for Businesses

PayHQ.ai provides a secure, unified payment solution that integrates open banking-powered security features with traditional payment methods, offering businesses:

✅ SCA-compliant, secure transactions, reducing fraud risks.

✅ AI-driven fraud prevention, detecting suspicious activity in real time.

✅ Elimination of chargeback fraud through irrevocable bank payments.

✅ Seamless bank-to-bank transactions, avoiding the risks of storing card details.

✅ A single, secure platform integrating traditional and open banking payments.

Industries Benefiting from Enhanced Payment Security

📌 E-Commerce & Retail: Lower fraud rates, faster checkout, and reduced chargeback disputes.

📌 Subscription-Based Services: Secure recurring payments with bank authentication.

📌 Financial Services & Lending: AI-driven fraud detection for risk management.

📌 Marketplaces & Gig Economy Platforms: Real-time security checks to prevent payment fraud.

📌 Healthcare & Professional Services: Data-secure transactions that meet compliance standards.

PayHQ.ai is leading this transformation by integrating open banking’s security features into a unified payment gateway, ensuring businesses can process payments securely, cost-effectively, and efficiently.

✅ 50% fewer fraudulent payment attempts with SCA and bank authentication.

✅ 60% reduction in chargeback-related losses by eliminating card fraud risks.

✅ 75% decrease in financial fraud with AI-powered fraud detection.

✅ Seamless integration with CRM, ERP, and financial platforms for secure transactions.

✅ Bank-grade security measures, eliminating the risks of storing payment details.