How a Single Payment Gateway Across Your Entire Business Can Supercharge Growth and Efficiency

How a Single Payment Gateway Across Your Entire Business Can Supercharge Growth and Efficiency

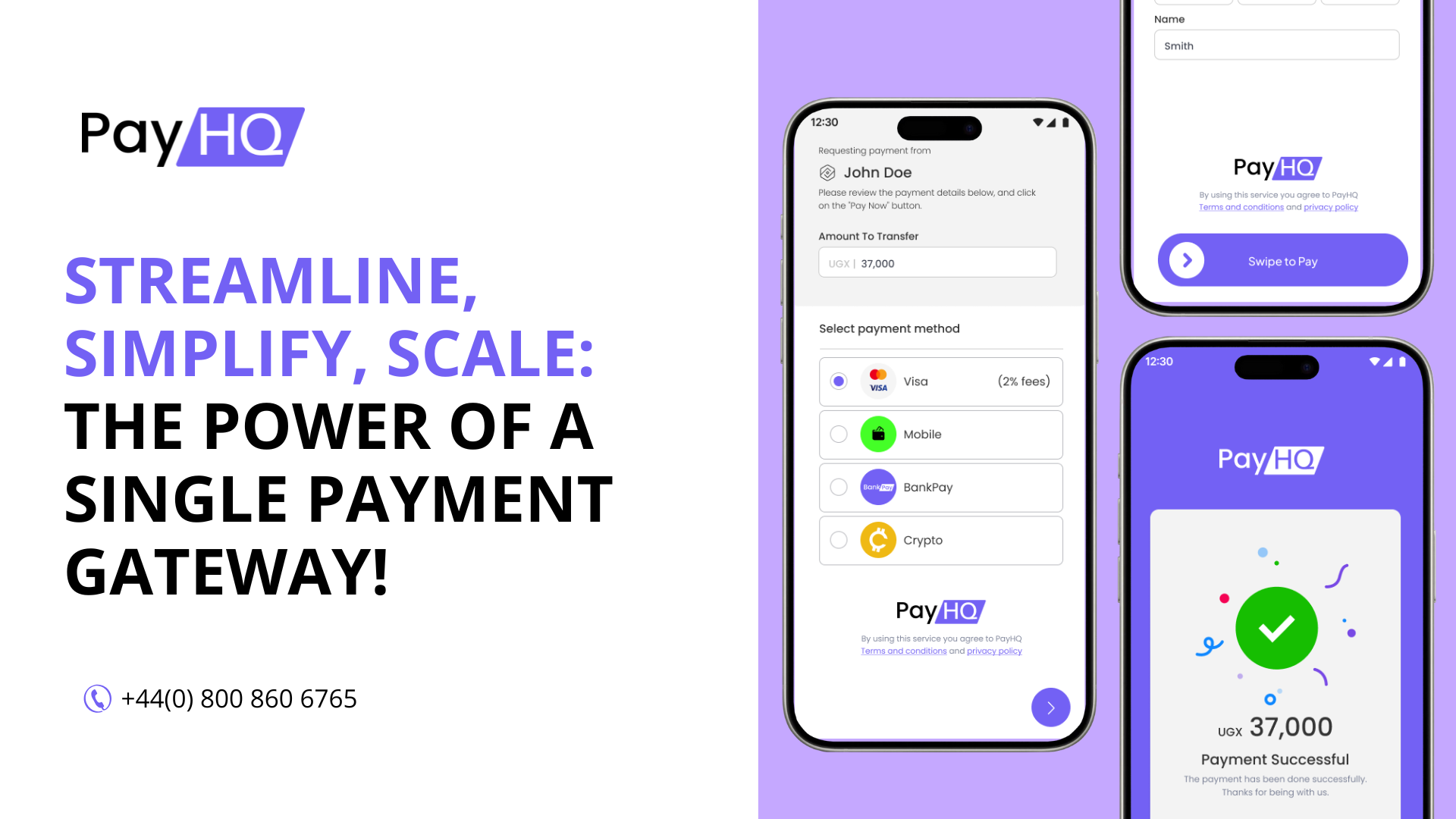

The Power of a Unified Payment System

In today’s fast-paced digital economy, businesses are constantly looking for ways to simplify operations, improve customer experience, and boost revenue. One often-overlooked strategy that can make a huge difference is implementing a single payment gateway across your entire business. Whether you run an e-commerce store, a subscription-based service, or a multi-channel retail operation, consolidating all your payment processing into one unified system can be a game-changer. In this article, we’ll explore the business benefits of using a single payment gateway and how it can help your business thrive.

What Exactly is a Single Payment Gateway?

A payment gateway is the technology that connects your business with payment processors, banks, and customers, enabling seamless transactions. A single payment gateway means using one unified system to handle all payment transactions across every aspect of your business—whether it’s online sales, direct bank payments, subscriptions, or recurring payments.

Instead of juggling multiple payment systems for different channels or payment methods, a single gateway centralises everything into one platform. This simplifies operations, cuts costs, and delivers a seamless experience for both your business and your customers.

For example, with PayHQ.ai, you can manage everything from single payments to variable recurring payments and standing orders—all in one place. This flexibility ensures you can choose the most cost-effective and efficient payment methods for your business needs.

Why Your Business Will Benefit from a Single Payment Gateway: 7 Key Advantages

- Say Goodbye to Chaos: Streamlined Operations

Managing multiple payment systems can feel like herding cats. Each platform comes with its own fees, reporting tools, and integration requirements. By consolidating into a single payment gateway, you eliminate the hassle of juggling multiple systems, saving time and reducing the risk of errors. This streamlined approach lets your team focus on what really matters—growing your business. - Happy Customers, Happy Business: Smoother Checkouts

A seamless checkout experience is crucial for customer satisfaction and retention. With a single payment gateway, customers enjoy a consistent payment process across all touchpoints—whether they’re shopping online, in-store, or via a mobile app. This consistency builds trust and reduces friction, leading to higher conversion rates and fewer abandoned carts. - Data at Your Fingertips: Smarter Decision-Making

A unified payment gateway gives you a centralised dashboard for tracking all transactions. This makes it easier to analyse sales data, monitor cash flow, and generate comprehensive reports. With real-time insights, you can make data-driven decisions to optimise pricing, marketing strategies, and inventory management. - Cut Costs, Boost Profits: Save on Fees

Managing multiple payment gateways often means paying multiple sets of fees, including setup costs, transaction fees, and monthly subscriptions. By consolidating into a single gateway, you can negotiate better rates, reduce overhead costs, and simplify financial management. For example, PayHQ.ai offers open banking solutions, which are one of the cheapest ways to collect payments, saving you money on every transaction. - Offer the Right Payment Methods for Every Customer

Different customers prefer different payment methods. With a single payment gateway, you can tailor the payment experience to suit your customers’ needs. For new clients, you can offer a variety of payment options like Buy Now Pay Later (BNPL) platforms (e.g., Klarna) or PayPal to increase conversion rates. For existing clients, you can guide them toward cheaper payment methods like direct debits or standing orders, reducing your transaction costs. - Open Banking Integration

Use a payment gateway that can allow you to use the key benefits of Open banking, from single payments to your bank, variable payments over time, standing orders, or client confirmation for AML/KYC. - Grow Without Limits: Scalability Made Simple

As your business grows, so do your payment processing needs. A single payment gateway can scale with you, accommodating higher transaction volumes, new sales channels, and expanding product lines without the need for additional integrations or system overhauls. It also ensures your financial data flows seamlessly across your business, giving you a clear picture of your performance.

Real-World Success Stories: How Businesses Are Winning with a Single Payment Gateway

- E-commerce Stores: Simplify online checkout processes and slash cart abandonment rates.

- Subscription Services: Automate recurring payments and manage collections effortlessly for regular clients.

- Multi-Channel Retailers: Unify bank and online payments for a seamless omnichannel experience.

- SaaS Companies: Handle global payments and subscriptions with ease.

- Marketplaces: Facilitate transactions between buyers and sellers while managing commissions and payouts.

How to Choose the Perfect Payment Gateway for Your Business

Picking the right payment gateway is crucial. Here’s what to look for:

- Seamless Integration: Ensure the gateway works smoothly with your existing systems (e.g., website, CRM, accounting software).

- Flexible Payment Options: Look for a gateway that supports the payment methods your customers prefer, including open banking, BNPL platforms, and direct debits.

- Top-Notch Security: Prioritise gateways with robust fraud prevention and data encryption tools.

- Transparent Pricing: Compare transaction fees, setup costs, and any hidden charges to find a cost-effective solution.

- Reliable Support: Opt for a provider with excellent customer service to resolve issues quickly.

Implementing a single payment gateway across your entire business isn’t just a technical upgrade—it’s a strategic move that can drive growth, improve efficiency, and delight your customers. By centralising your payment processing, you can streamline operations, reduce costs, and gain valuable insights into your business performance. In an increasingly competitive market, a unified payment gateway can give your business the edge it needs to succeed.

If you’re ready to take your business to the next level, it’s time to explore payment gateway solutions that align with your needs. The investment in a single, robust payment system will pay off in the form of happier customers, smoother operations, and a stronger bottom line.