How Open Banking and Instant Payments Are Shaping the Future of Financial Transactions

How Open Banking and Instant Payments Are Shaping the Future of Financial Transactions

The Demand for Faster, More Efficient Payments

In today’s digital economy, speed is everything. Consumers expect instant transactions, businesses require real-time cash flow, and financial efficiency is more crucial than ever. Yet, traditional payment systems, with their delays, high processing fees, and reliance on intermediaries, are struggling to keep up. Enter open banking.

By leveraging Payment Initiation Services (PIS), open banking is revolutionising the payment landscape by enabling instant, direct account-to-account (A2A) payments. This innovation eliminates delays, reduces costs, and offers a superior financial experience for businesses and consumers alike.

In this article, we’ll explore how open banking is transforming instant payments, why businesses should embrace it, and how PayHQ.ai is leading the charge by integrating traditional gateways, open banking, and other payment solutions into a single unified platform to drive financial efficiency.

The Problems with Traditional Payment Systems

Before open banking, businesses had to rely on slow and expensive payment methods:

- Card payments: Typically take 2-3 days to settle, slowing cash flow.

- Bank transfers: Require manual intervention, leading to delays and errors.

- Payment intermediaries: Charge high transaction fees, cutting into profits.

For businesses operating in e-commerce, retail, and subscription-based services, these inefficiencies reduce profitability and frustrate customers. Instant payments via open banking solve these issues.

How Open Banking Enables Instant Payments

- Real-Time Fund Transfers

- Traditional transactions require multiple steps and intermediaries.

- Open banking payments are direct, eliminating delays and reducing settlement times to seconds.

- PayHQ.ai integrates this functionality into a unified payment gateway, ensuring businesses get paid faster while supporting other payment methods like cards and digital wallets.

Statistic: Businesses using instant bank payments see a 35% improvement in cash flow management (Source: UK Finance).

- Reduced Transaction Costs

- Card networks charge processing fees ranging from 1.5% to 3.5% per transaction.

- Open banking removes intermediaries, reducing costs by up to 90%.

- PayHQ.ai intelligently prioritises the most cost-effective payment method, whether through open banking, traditional card payments, or alternative gateways.

Statistic: Companies switching to open banking payments save an average of £15,000 per year in processing fees (Source: Deloitte UK).

- Secure, Seamless Transactions

- Open banking transactions use Strong Customer Authentication (SCA) and bank-level security.

- Fraudulent chargebacks, common with card payments, are eliminated.

- PayHQ.ai’s AI-driven fraud detection ensures transactions remain safe and verified across all integrated payment methods.

Statistic: Open banking reduces fraudulent transactions by 50% compared to traditional card payments (Source: Financial Conduct Authority UK).

- Enhanced Customer Experience

- Faster checkouts with direct bank payments instead of lengthy card authorisations.

- Multiple payment options, allowing customers to choose between bank transfers, cards, and digital wallets.

- PayHQ.ai’s embedded payment links enable customers to pay invoices instantly with a single click, no matter which payment method they prefer.

Statistic: Businesses offering instant bank payments see a 40% increase in checkout conversion rates (Source: PayUK).

How PayHQ.ai is Driving Instant Payments with Open Banking and Unified Payment Gateways

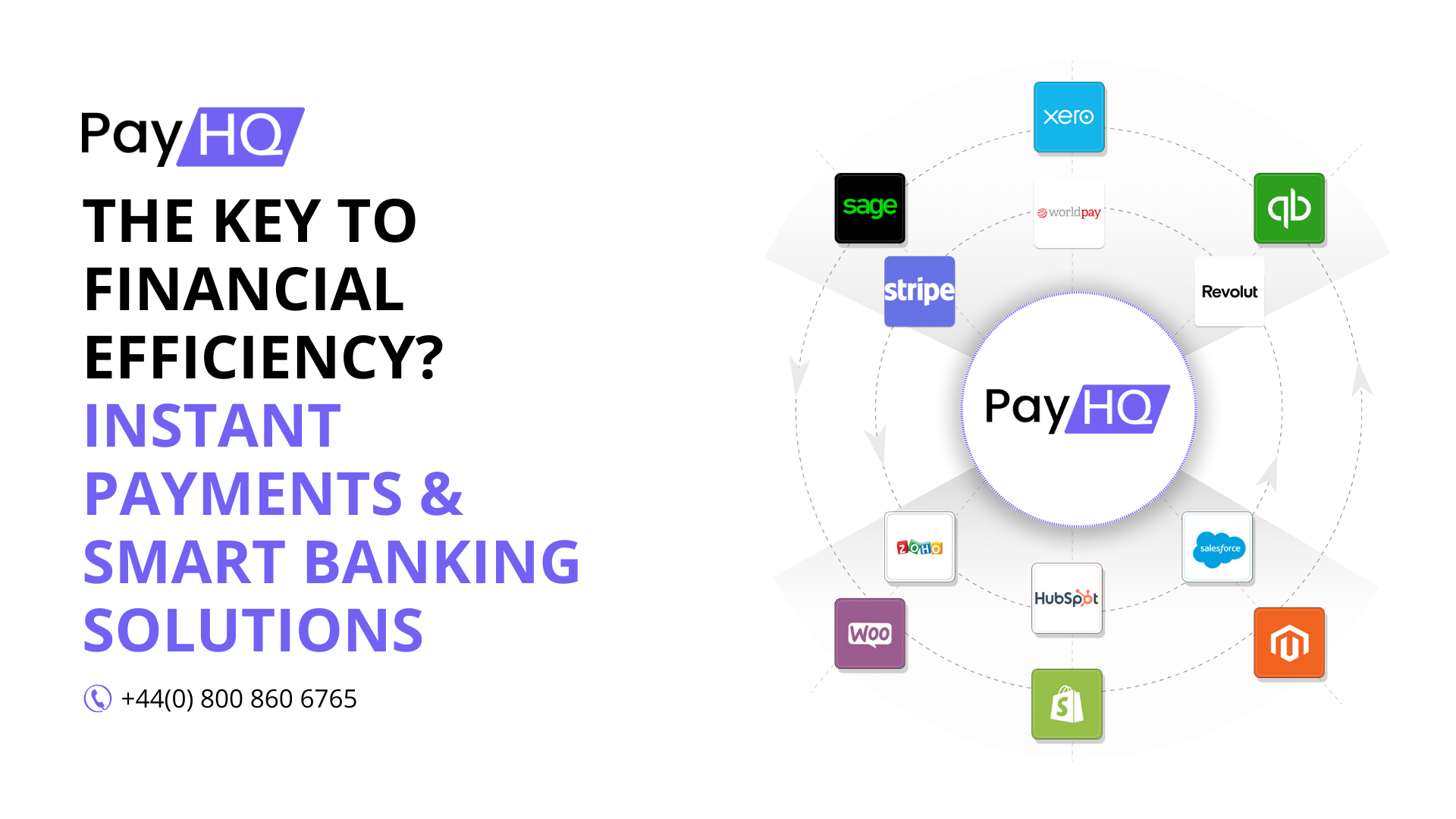

PayHQ.ai is revolutionising how businesses handle payments by integrating traditional gateways, open banking-powered instant payments, and alternative digital payments into a unified platform.

✅ Instant bank transfers ensure businesses get paid in real time.

✅ Lower transaction costs by eliminating expensive intermediaries and prioritising cost-efficient methods.

✅ Fraud prevention and AI-driven security protect businesses from payment risks across all methods.

✅ Seamless integration with e-commerce, CRM, financial systems, and ERP platforms.

✅ Multi-channel payments allow businesses to accept bank transfers, cards, alternative payment gateways, and digital wallets from one system.

Industries Benefiting from Instant Payments via Open Banking and Unified Payment Systems

📌 E-Commerce & Retail: Reduce abandoned carts with seamless checkouts and flexible payment methods.

📌 Subscription-Based Services: Improve retention with real-time recurring payments and diverse billing options.

📌 Freelancers & Small Businesses: Faster invoice payments improve cash flow with instant settlements.

📌 Marketplaces & Gig Economy: Enable instant payouts for sellers and service providers through multiple payment options.

📌 Financial Services & Lending: Speed up loan disbursements and repayments with real-time transactions across various banking and payment platforms.

The time for instant payments is now. Reduce costs, improve cash flow, and enhance security with PayHQ.ai—your unified payment gateway for the future.

✅ 35% improvement in cash flow with real-time payments.

✅ Up to 90% lower transaction fees by optimising payment methods.

✅ 50% reduction in fraud risk with secure authentication.

✅ 40% higher checkout conversions with frictionless and diverse payment options.